Invest In Kurdistan: Overview of Priority Sectors

Report Summary

Invest Kurdistan’s Team

Kurdistan Region at a Glance

The Kurdistan Region of Iraq (KRI) is an autonomous region in northern Iraq, nestled at the crossroads of Europe, Asia, and the Middle East. It is governed by the Kurdistan Regional Government (KRG) and has its own legislative body. The Kurdistan Region is known for its rich oil and gas reserves, fertile land, and business-friendly environment. The region offers investors a wide range of opportunities in all sectors, particularly agrifood, industry, tourism, infrastructure, and services. With a population of 6.2 million, the potential for growth in these sectors, combined with the region's abundant natural and human resources, makes the region perfectly positioned for investment and expansion. KRG's commitment to economic development, security, and political stability makes the region a prime destination for investors looking to invest in Iraq and the MENA region.

Why Choose Kurdistan Region?

Many factors make the Kurdistan Region an excellent investment destination, including stability, abundant natural resources, favorable investment legislation, skilled workforce, strategic location, diverse sectors, and booming local and regional demand.

The region's economy has grown significantly over the past two decades; the GDP per capita is about $7,038 in 2022. It has received major investment from both local and foreign investors since 2006, with total invested capital exceeding $66 billion. The government is actively seeking to attract more investment projects to the region and has a dedicated team to support investors and facilitate the investment process.

Agrifood Sector

Kurdistan Region has fertile lands, a temperate climate, and water resources that make it suitable for the production of a wide range of food crops and livestock products. Coupled with booming regional demand, these make the region an optimal location for investment in agriculture and food processing.

Today, Iraq as a whole imports every year more than $1 billion of dairy products, 600,000 tons of meat, 3 billion eggs, and $700 million of fresh and processed fruits, despite having excellent agro-climatic conditions for producing all of these commodities.

Since most of the food consumed in Iraq is imported, investors with efficient production techniques can gain a first-mover advantage and secure a strong market position. The main agricultural commodities for which the Kurdistan Region is known and which have a large local and regional market cover grains and pulses, vegetables, fruits, and livestock.

Reasons to Invest in Agrifood Sector

Many reasons make the region attractive for investment in agricultural and food processing projects, such as a significant amount of agricultural land, which exceeds 4 million hectares, water resources from 5 major rivers and 3 large lakes, and fertile land offering optimal conditions for a wide variety of agricultural products. In addition, the market is growing with little competition, accompanied by local labor availability, as more than 10% of the labor force is engaged in agriculture. Kurdistan is also the home to 14 agricultural colleges and more than 40 agricultural extension centers driving technology-oriented entrepreneurs.

Top Opportunities in Agrifood

Since local and regional demand far exceeds supply for virtually all agricultural products, Kurdistan offers a wide range of climatic zones for the production of most crops and livestock.

Livestock and Dairy

Iraq imports more than $2 billion of meat, eggs, and dairy products annually. With a growing population and increasing incomes, demand is growing by 8% annually. Kurdistan offers the ideal location for investors seeking to supply the fast-growing market and is particularly keen to attract investments in cattle farms for milk or beef production, sheep/goat farms for meat or wool production, poultry farms for chicken or egg production, and fish farms using modern fishery techniques.

Crop Cultivation

The region's primary commodities include grains such as wheat, barley, and corn, as well as a range of fruits and vegetables, including pomegranates, apples, grapes, olives, and tomatoes. In 2020, the region produced over 2.4 million tons of wheat and 250,000 tons of barley. The government also seeks to attract investments in setting up demonstration farms and working in collaboration with networks of local out-growers to establish modern greenhouses, model farms and packing operations, orchards, and large-scale grain cultivation.

Food Processing

Large amounts of processed foods in Iraq are packed in the country but using imported raw materials. The regional government welcomes investors who are interested in setting up processing and packaging facilities for the processing of a wide range of food products, such as meat, dairy, and vegetables, to name a few. Other investment opportunities include agrifood logistics, animal feed manufacturing facilities, and certified seed forest plantations.

Industry Sector

Driven by oil and gas revenues, rising household incomes and large-scale infrastructure reconstruction, demand for all types of manufactured products in Iraq is growing rapidly - for construction materials, chemicals and fertilizers, vehicles and machinery, consumer goods, and others.

With abundant energy sources, local supplies of most raw materials, and a favorable business environment, the Kurdistan region is the ideal location to set up manufacturing operations to serve this fast-growing market - and potentially export to other expanding markets in the region.

Over the last 15 years, investors have already invested more than $30 billion in manufacturing projects in Kurdistan, but numerous untapped opportunities remain. Petrochemicals and fertilizers, and construction materials are the two biggest immediate opportunities.

Reasons to Invest in the Industry Sector

Demand: After long periods of war and instability, the scale of expenditure across Iraq on reconstruction is enormous - this, in turn, is fuelling massive demand for construction materials, industrial machinery, vehicles, appliances, consumer goods, agricultural chemicals, and more. On average, Iraq imports more than $5 billion of construction materials, $5 billion of industrial machinery, $3.5 billion of vehicles, $2.5 billion of plastics and chemicals, and $2 billion of electrical equipment and parts annually.

Energy and Raw Material Supply: Kurdistan has large reserves of oil and natural gas, as well as deposits of many other key raw materials. Investors can take advantage of this local supply base to competitively supply Iraq and neighboring countries.

Strategic Location: Kurdistan is located at the crossroads of Europe, Asia, and the Middle East. Manufacturers in Kurdistan have full access to the whole of Iraq and good transport connections to other fast-growing markets in the region.

Global Diversification: With the production of petrochemicals and other key materials increasingly concentrated in a small number of countries, manufacturers are looking for new competitive locations to establish operations.

Government Support: The Government is ready to provide full support to companies who set up manufacturing operations in the region - Kurdistan’s Investment Law offers free land, utility connections, and exemptions from income tax and customs duties.

Skills and Technology: Fuelled by inward migration and the opening of numerous new colleges and universities, Kurdistan offers investors a large skilled workforce and a strong base of engineers with practical knowledge of the latest production and construction technologies.

Petrochemical

Iraq imports more than $2.5 billion of fertilizers, plastics, and other chemicals every year. With plentiful reserves of oil and gas, Kurdistan offers the ideal location for production to supply unmet demand within Iraq. With the revitalization of the agricultural sector, the development of new manufacturing industries, and increased consumer spending, demand for petrochemicals will continue to grow rapidly.

Investment Opportunities in the Petrochemical Industry

The region produces 450,000 barrels and over 450 million standard cubic feet per day of output of oil and gas, respectively; the region floats on 45 billion barrels of natural oil and over 200 trillion cubic feet of gas, positioning it as a compelling destination for petrochemical investment. Iraq imports approximately 1.4 million tons of fertilizers and over $2.5 billion worth of plastic and chemicals per year. KRG aims to become a leading supplier of petrochemical products in a number of market-driven opportunities, including the production of fertilizer, polymer, rubber, and more.

Manufacturing

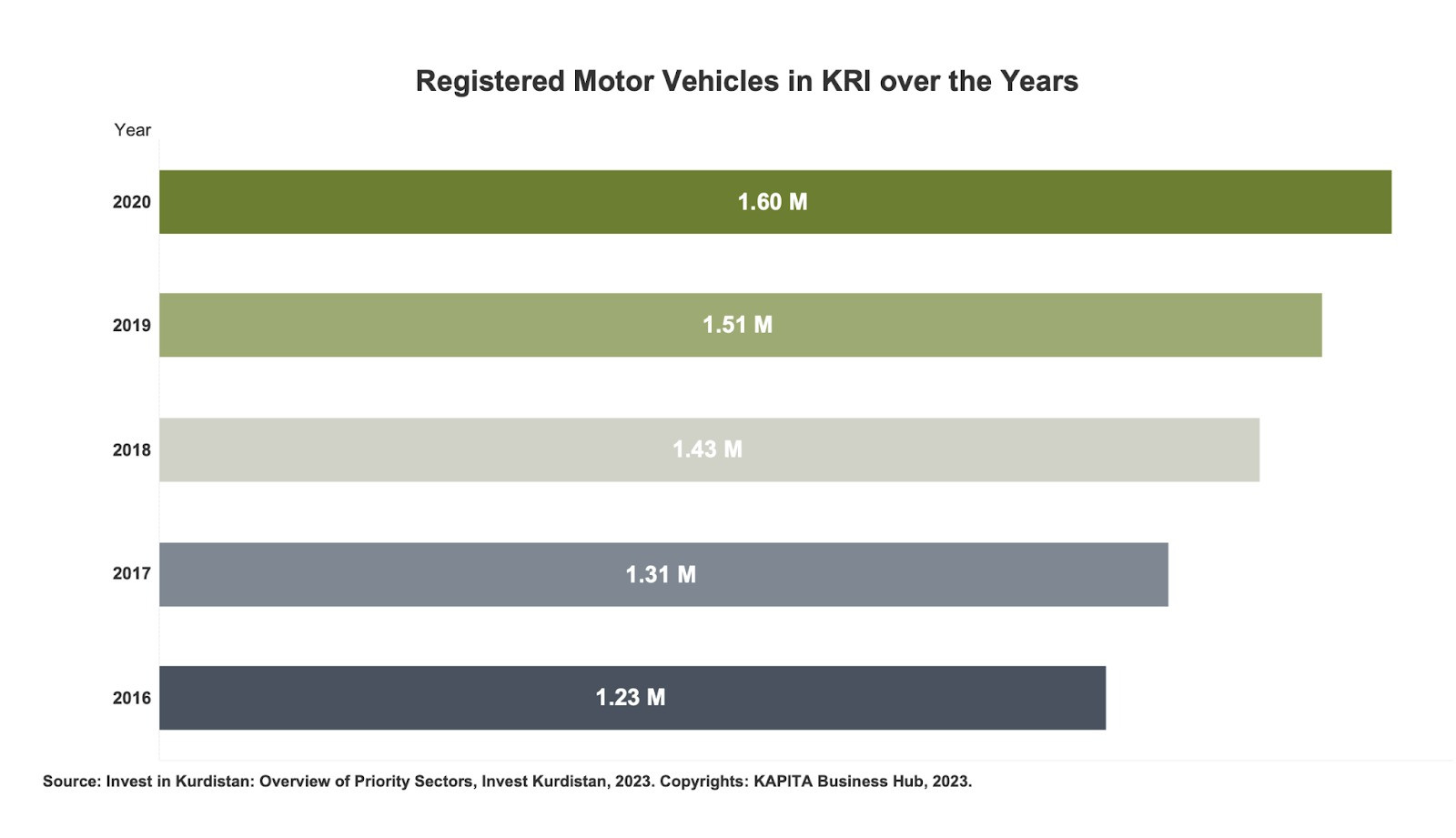

Driven by economic growth, demand for all types of manufactured products in Iraq is growing rapidly. Demand for construction materials is particularly strong. For example, Iraq still imports more than 4 million tons of steel, 10 million tons of gypsum board, and 200 million square meters of ceramics every year. Demand for automobiles, automotive spare parts, household appliances, and electronics is equally robust. The number of registered motor vehicles in Iraq has almost doubled over the last 10 years, and ownership of household appliances and electronics has been growing at similar rates. Additionally, demand for consumer electronics, pharmaceuticals, and packaged consumer goods is also increasing.

Investment Opportunities in the Manufacturing Industry

Data shows that $88 billion is the total investment in construction and infrastructure projects required to complete post-war reconstruction; 7.2 million is the number of registered motor vehicles in 2022, and $3.5 billion is the value of imported vehicles and automotive parts in 2022. On the other hand, in 2022, the values of imports of electronic equipment and parts and household appliances are $7 billion and $1.5 billion, respectively. In the last 16 years, BOI licensed 290 manufacturing projects. Therefore, Kurdistan offers a conducive environment for manufacturers, with plentiful energy reserves and generous investment incentives. Investment opportunities exist for every type of manufacturing operation, such as construction materials, including iron, steel, and gypsum board, appliances and electronics, the automotive industry; and light manufacturing, including FMCG production and packaging.

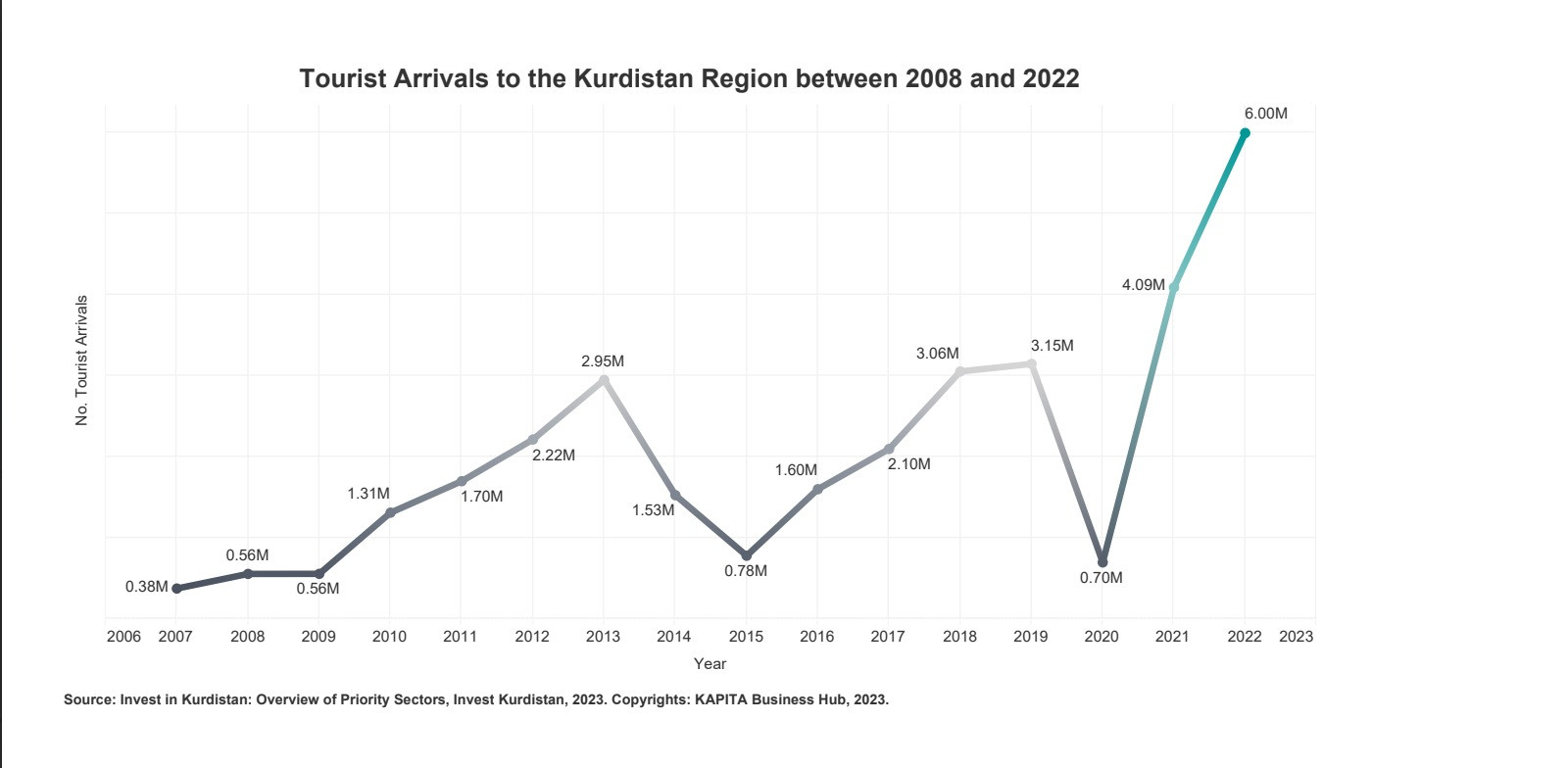

Tourism Sector

The Kurdistan Region is a unique and diverse destination that offers a wide range of tourism opportunities. Known for its natural beauty and rich culture, it attracts 6 million tourists year-round from all over Iraq and beyond.

The KRG has a well-developed hospitality infrastructure, a growing number of tourist-friendly facilities such as hotels, restaurants, heritage sites, and a welcoming and hospitable population.

Investment opportunities are abundant with almost 40 resort developments identified as investment priorities. These opportunities come with allocated land, topology analysis and project concept development plans.

The Kurdistan BOI has licensed more than 180 tourism projects over the last 15 years, and total investment in tourism projects in the region now exceeds US$ 13 billion, most of it concentrated in Erbil with US$10 billion, followed by Sulaymaniyah and Duhok.

Investment Opportunities in the Tourism Sector

The Kurdistan regional government has recently completed a comprehensive tourism development master plan. As part of the plan, the government has identified and set aside around 40 high-potential sites for tourism development.

Below are the names of some of the areas available for development as tourist resorts throughout the Kurdistan Region

Jundyan, Handren, Hasan Bag, Korak and Zrara in Soran.

Qalay Dwin, Tawska, Dlopa, and Garaw in Erbil.

Hazar Merd, Kunaba, Bani Maqan, and Zrgwez in Slemani.

Rania Forest, Jolanan, and Qurago in Raparin.

Sirwan River, Bawashaswar, and Essayi in Garmian.

Bejil, Kani Mazi, Gari Spilke, Ashawa, and Qubahan in Duhok.

Ahmadawa and Rishen in Halabja.

Sharanish and Gali Zakho in Zakho.

Service Sector

With the swift development of the regional economy over the last 15 years, the services sector in Kurdistan has blossomed and now constitutes the largest segment of economic activity. Kurdistan is now home to more than 25 banks, 15 private colleges and universities, dozens of telecom and technology providers, and hundreds of retail chains and shopping malls. Notable investors include the University of London, American University, Zain Telecom, QNB Group, Carrefour, and many more.

ICT Sector

The Information and Communication Technology (ICT) sector in Kurdistan has been growing rapidly in recent years, fueled by a combination of government support, private investment, and a young, tech-savvy population. With the KRG strongly emphasizing developing the ICT sector as a key driver of economic growth, the region has become a hub of innovation and technology entrepreneurship. The Kurdistan region is now home to more than 500 ICT startups and 4 incubators, technology hubs, and co-working spaces.

Digital transformation is one of the Kurdistan Regional Government’s top priorities. Recognizing the importance of the ICT sector to the region’s economy, the government has developed and implemented the Digital Transformation Strategy 2022-2025, which focuses on improvements in services to citizens, e-government, and digital infrastructure.

Reasons to Invest in ICT Sector

The KRG proactively promotes the development of the ICT sector, with policies aimed at creating a conducive environment for investment and growth. Additionally, there is a large pool of engineering, computer science, and IT professionals (over 20,500 graduates of ICT studies every year), high demand for digital services as the internet penetration rate is 75%, around 4 million internet users, 850 smartphones per 1000 individual, and other incentives such as tax breaks, land allocation, and exemption from customs duties.

Investment Opportunities

The government is keen to attract additional investments in local ICT infrastructure in the following areas: tower-sharing companies, data centers and cloud servers, software companies (e.g., e-commerce platforms and mobile payment systems), and developers of special zones/hubs/incubators for ICT/BPO services.

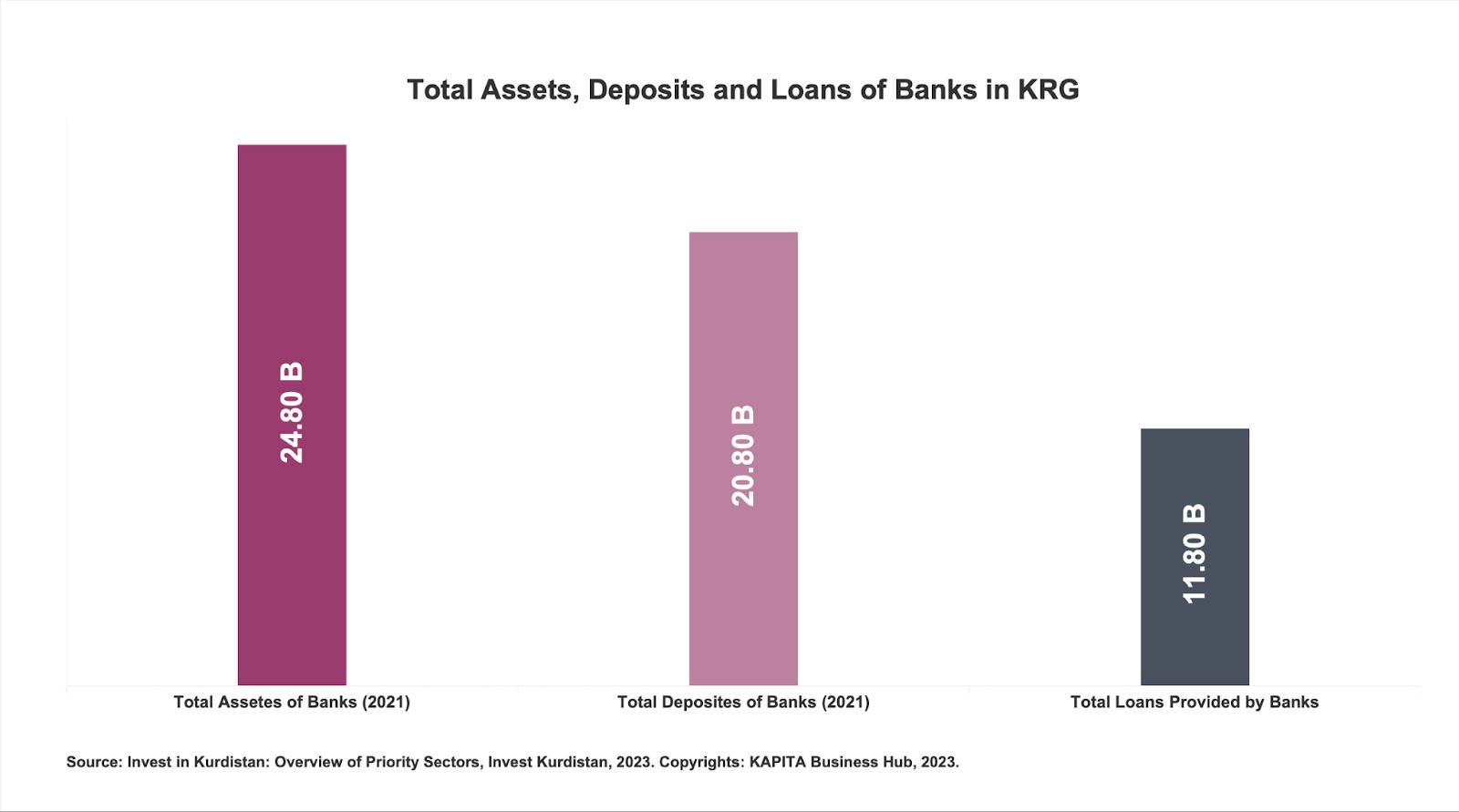

Financial Services and FinTech

Despite the rapid development of financial services in recent years, financial services in the region are still under-developed: bank account utilization is still relatively low, use of cards and digital banking is very limited, access to finance for local entrepreneurs is still very restrictive, many non-banking financial services barely exist - insurance, mortgage lending, leasing, wealth management services, etc.

The regional government has recently taken steps to accelerate financial inclusion and development of financial services by requiring all government employees and contractors to be paid digitally directly to bank accounts. This and other reforms will open up a wide range of opportunities for investors in banking, non-banking financial services, digital payment services, and FinTech in general.

The region presents a wide range of opportunities, including insurance services, mortgage lending, lease financing, wealth management services, and many other financial/banking services.

Infrastructure Sector

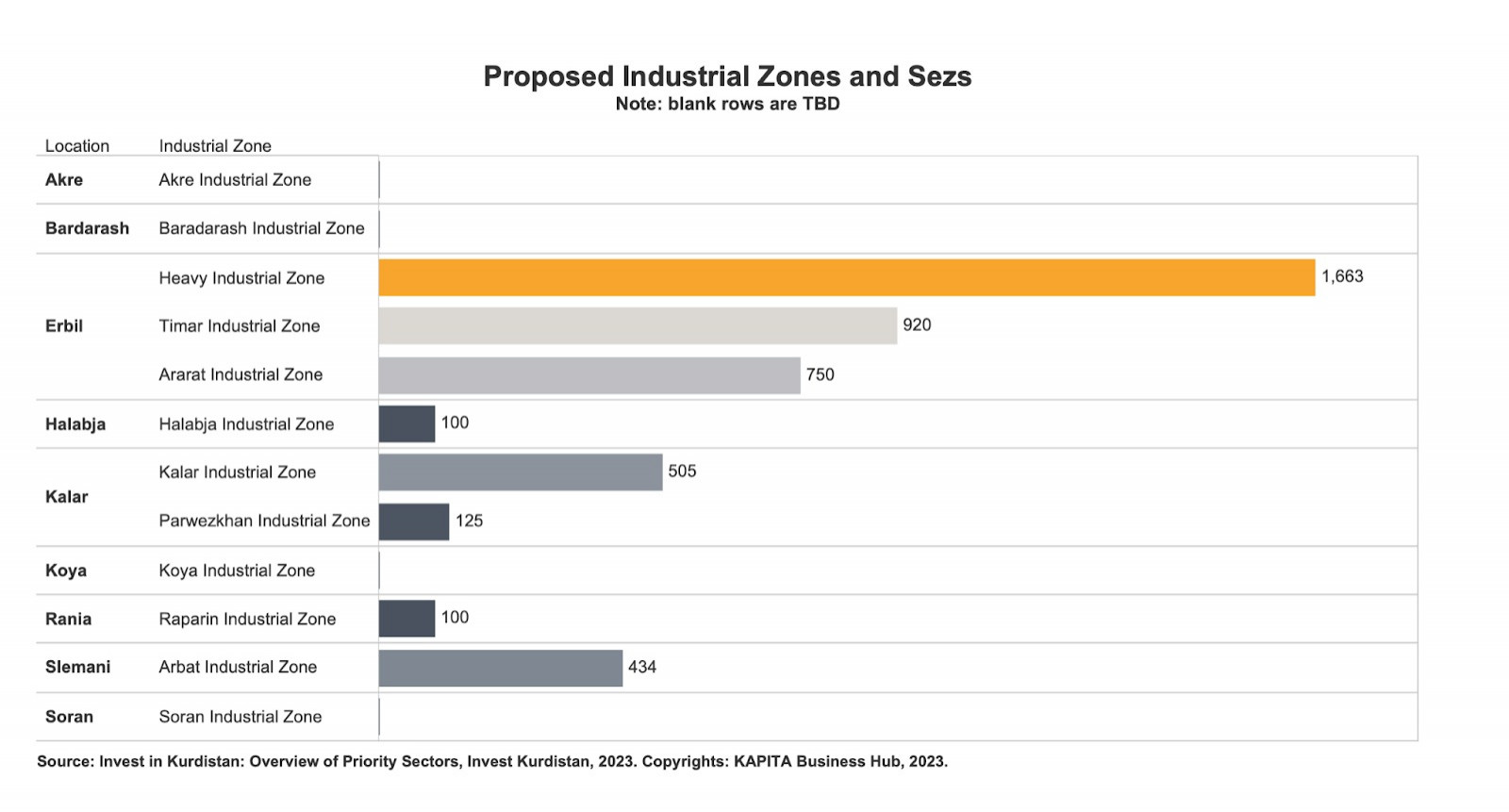

Development of Industrial Zones and SEZs

The Kurdistan Regional Government strives to enable industrial development through the establishment of industrial zones and special economic zones (SEZs) for various industrial activities in all parts of the region. The Board of Investment (BOI) of the Kurdistan Region seeks to attract investors to develop the remaining proposed zones, 12 zones located in all governorates. The land for 8 of these zones has already been identified and set aside; the government is in the process of acquiring the land for the 4 remaining zones. Some of the zones are expected to focus on specific activities (heavy manufacturing, light manufacturing, agro-processing, trade and logistics, services, etc.); others will be mixed-use zones.

Renewable Energy

The current electricity demand far exceeds supply: peak demand exceeds 7000 MW and is growing by 10% per year, while current generating capacity is less than 4000 MW. Several private investors have already established independent power projects supplying the regional power grid, but there is ample demand for more.

In line with the government strategy to reduce dependence on hydrocarbons, the government is particularly keen to attract power projects that will utilize renewable and waste energy sources: solar, wind, hydro, geothermal, as well as flared/wasted gas and industrial/municipal/agricultural waste. The Ministry of Electricity has already approved 4 solar photovoltaic (PV) projects and 2 waste-to-energy projects. With commercial electricity tariffs around IQD 13/kWh and residential tariffs for larger users exceeding IQD13/kWh, the Ministry of Electricity is in a position to purchase power from independent generators at rates that ensure reasonable returns.

With numerous corporate groups establishing large-scale manufacturing projects that require substantial power (e.g. for the manufacture of steel, cement, urea, etc.), opportunities for captive power projects and net-metering arrangements present particularly interesting options.

The government is also keen to attract financial institutions, and companies prepared to design financing packages for residential and commercial solar rooftop installations.

Reasons to Invest in the Energy Sector

Massive and growing gap between electricity demand and supply.

Several successful IPPs are already operational.

Reasonable end-user tariffs ensure sustainable returns for independent power producers.

Multiple opportunities for captive and/or net-metering power projects with attractive tariffs.

Plentiful potential energy sources: high levels of solar radiation year-round; untapped flared gas supplies; undeveloped hydro sites; growing supplies of industrial and municipal waste.

Full government support: given the supply-demand gap and the government’s desire to reduce reliance on hydrocarbons.

Investment Opportunities

Co-development of captive power plants (using solar, flared gas, waste-to-energy, etc.) in collaboration with developers of new energy-intensive businesses - manufacturing operations, industrial parks, large-scale residential/commercial/tourism developments, etc.

Co-development of net-metering power plants (using solar, flared gas, waste-to-energy, etc.) in collaboration with large corporate groups with heavy electricity usage for existing residential/commercial/industrial businesses.

Independent Power Projects (using solar, flared gas, waste-to-energy, hydro, etc.) under power-purchase agreements with the Ministry of Electricity.

Financial/technical consortia ready to launch integrated financing and installation packages for residential and commercial solar rooftop installations.

Transportation Sector

Transportation infrastructure in the Region has improved significantly in recent years, with new roads, bridges, and airports being built to support the growing economy. Nevertheless, with economic growth and inward migration, there is an urgent need to expand and improve all aspects of Kurdistan’s transportation - public transport systems, roads, railways, and air services.

Reasons To Invest in the Transportation Sector

Projected demand for all transport nodes far outstrips current capacity. Data shows that total air passengers, at Erbil and Slemani Airports, reached 3.4 million passengers in 2019 while

registered taxis reached 76,000 in 2022. The KRG estimated 38,000 tons in volume of cargo trade through the main border-crossing in 2019. Therefore, the Kurdistan Regional Government has completed detailed master plans and full feasibility studies for new public transport systems, roads, railways, air services, intermodal hubs, etc.

Investment Opportunities

Short-term Opportunities:

Taxi-meter system in KRI.

Establishing a network of (102 km) two-way tramways along Erbil city.

Establishing a (70 km) two-way City bus network in Erbil city.

The Medium-term Opportunities:

Establishing a 60km network of two-way tramways in Sulaymaniyah city.

Establishing a 55km network of two-way tramways in Duhok city.

Establishing a 50 km two-way City bus network in Sulaymaniyah city.

Construction of a modern transport terminal with associated services in Duhok.

Construction of 820 km of highways to connect Kurdistan’s major cities and neighboring countries.

Construction of a new 650km railway from the Turkish border at Zakho to the Iranian border at Bashmaq (via Duhok, Erbil, Sulaymaniyah, Penjwen).

Construction of a modern transport terminal with associated services in Halabja.

Establishing a cargo logistics center in Erbil, with parking and loading bays and associated administrative, security, and commercial services.

Water System

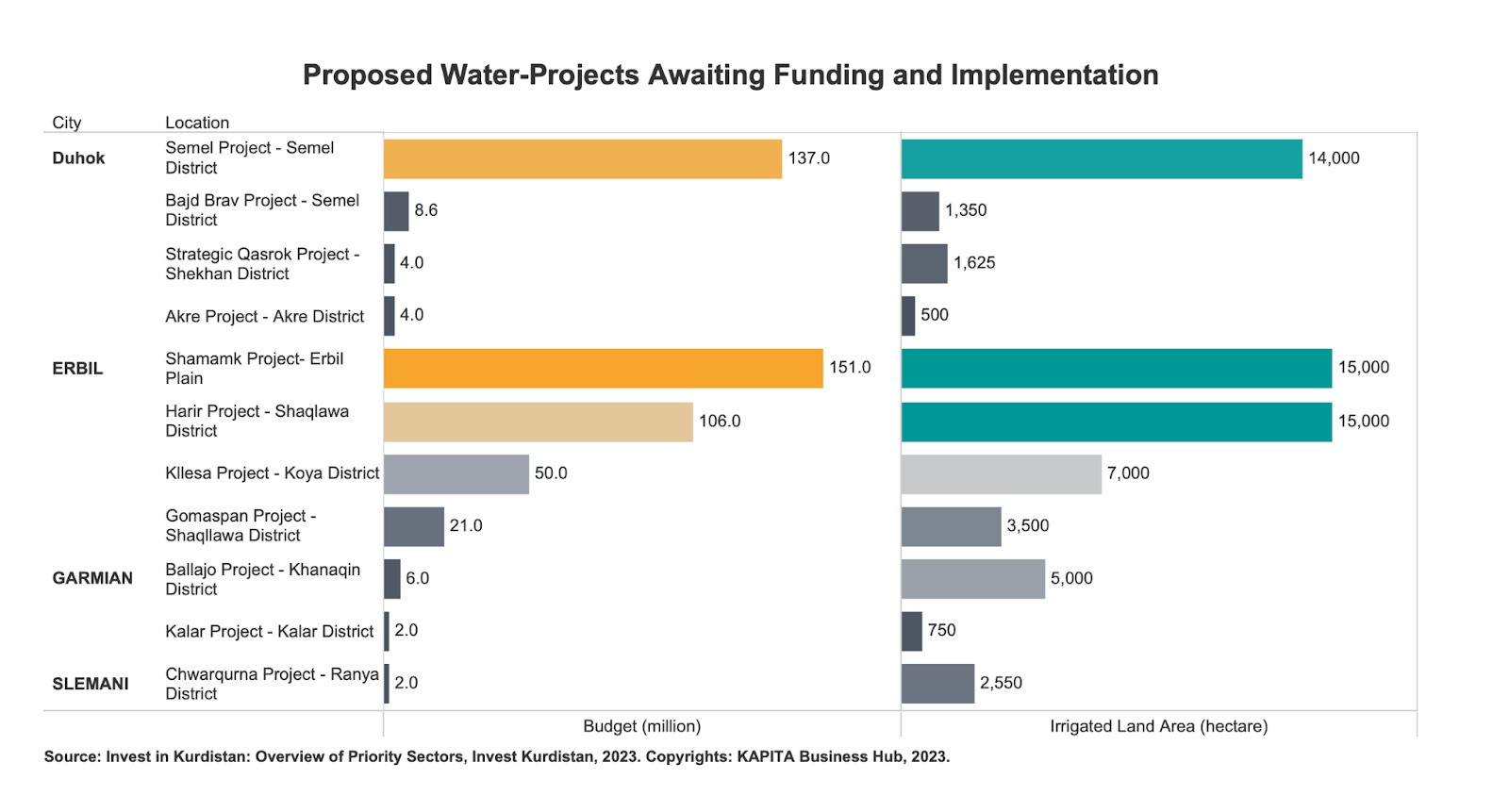

With 6 major rivers, snow-capped mountains, and annual precipitation similar to many parts of Western Europe, the Kurdistan region has a wealth of water resources. The annual water output of rivers in 2019 was around 31 billion m3. The Kurdistan Region has untapped opportunities for dams and irrigation/water-supply schemes on each of the 5 main river basins, 25,000 wells, 17 constructed dams, and other water resources. In terms of land and irrigation accessibility, the total irrigated area is 285,000 hectares, and a total of 2,700 km of irrigation canals. It is also estimated that the annual rainfall precipitation range is from 350mm in the southwest plains to 1100mm in the northwest mountains.

Despite numerous water resources, much of them are utilized inefficiently: urban, agricultural, and industrial users in the region are increasingly tapping underground water resources to meet growing demand. As a result, many aquifers are running dangerously low.

Investment Opportunities

The Kurdistan Regional Government has completed feasibility studies and plans for 41 proposed ponds and 11 proposed water projects awaiting funding and implementation across the region. Moreover, the government is actively seeking investors interested in developing new dams and irrigation/water-supply schemes under Public-Private Partnerships (PPP).