This brief can be cited as:

KAPITA. "The Rise of Streaming Services in the Iraqi Market”. August 25, 2023. http://tinyurl.com/55chtcp7

The streaming market refers to the industry of delivering multimedia content, including videos, music, and games, to users over the internet without the need for downloading the content to a device first. The streaming market in Iraq is still in its early stages, but it is rapidly developing due to the increasing accessibility of broadband internet and high consumption of on-demand content.

Data show that revenue in the paid video streaming segment is projected to reach $78.69 million in 2023 in Iraq, while the music streaming segment is expected to reach $7.13 million in 2023.

In this brief, we explore the paid streaming services in the Iraqi market through an analysis of the market potential, available streaming platforms, and major challenges faced by the industry.

International paid video streaming services have penetrated the Iraqi streaming scene over the previous years. STARZ PLAY is a subscription VOD service that streams thousands of Hollywood movies, TV shows, documentaries, kids' entertainment, and dedicated Arabic and Bollywood content. It partnered with AsiaCell In 2019 and Earthlink In 2023, enabling all "Unlimited" monthly package content and Almanasa, respectively. In addition, we look at other video streaming services, such as Netflix, Spotify, Amazon Prime, and Disney+, to name a few.

We also explore several paid audio streaming services: Spotify, Anghami, Deezer, Apple Music, and SoundCloud. These platforms have gained remarkable popularity among Iraqi audiences. For example, Spotify entered the Iraqi streaming market in 2021 with 1.4 million users as of August 2022. Music streaming is the primary content, with some offering podcasts.

This brief examines the market potential of these paid platforms. The country’s young and growing population of 43 million individuals, with a median age of 21, presents a young demographic with high potential for digital adoption. This coupled with 33.7 million internet users and 45.7 million mobile connections in 2023, makes Iraqi a lucrative market for the streaming industry. There are other contributing factors, including purchasing power and globalization, which are examined in detail.

This brief presents an in-depth customer behavior analysis examining various factors.

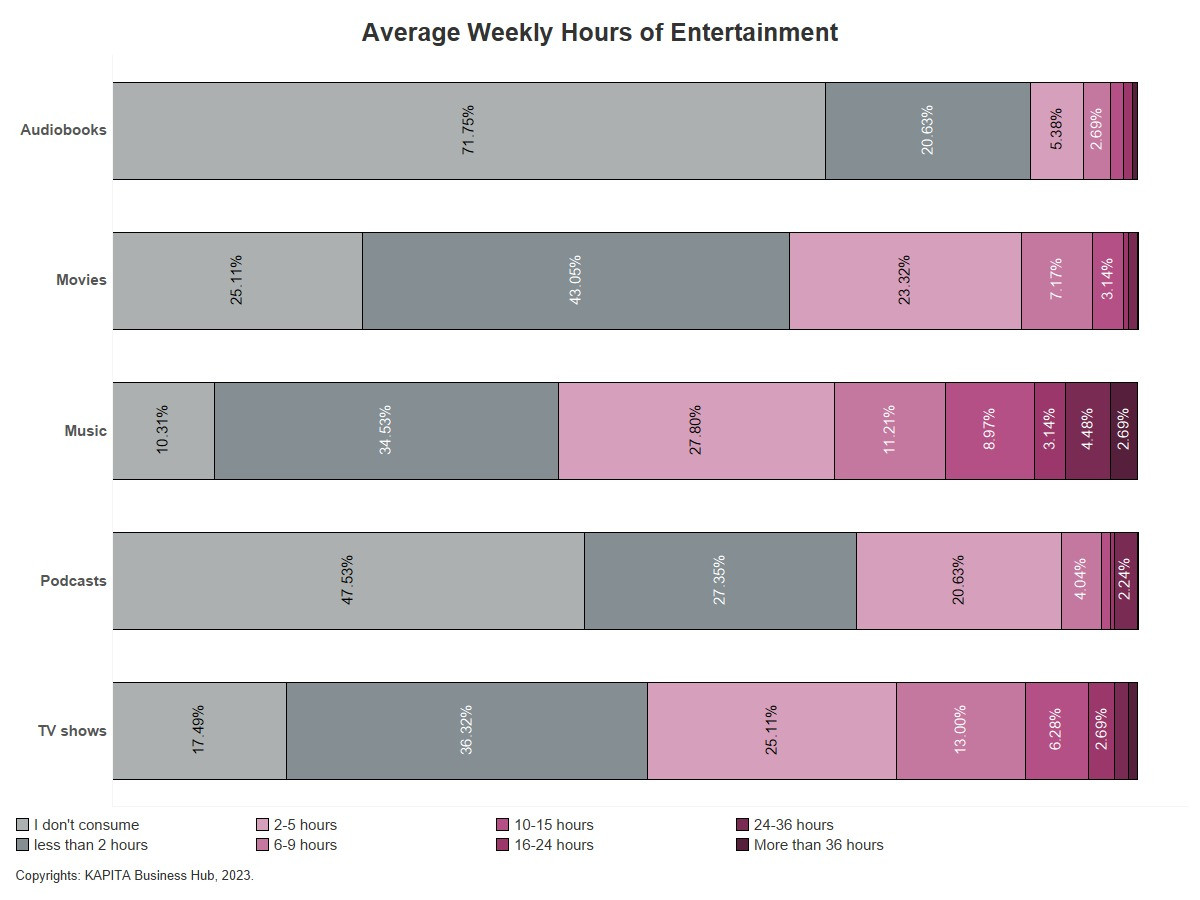

The average weekly hours spent on entertainment varies and depends on the type of content.

The results indicate that only 37.5% of the respondents reported subscribing to streaming services, while the remaining 62.5% stated otherwise.

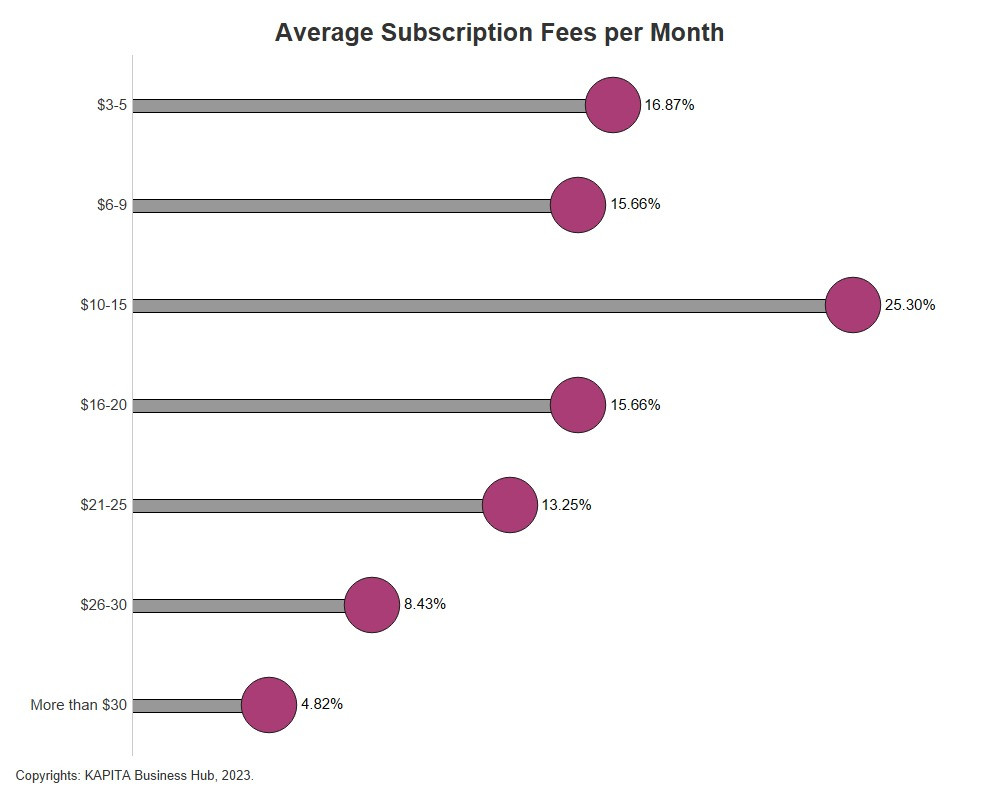

Our survey shows interesting statistics regarding monthly average subscription expenditure. The majority spend $10-$15 per month on subscription fees, while 5% spend more than $30 monthly.

As for the motivation of why Iraqis subscribe to streaming services, content library and convenience seem to be the leading motives.

We also examine the determinants of subscription to streaming services. The results indicate that the availability of free content is the leading deterrent, making up to 69% of our surveyed sample.

The widespread use of mobile phones has made them the preferred device for entertainment compared to other devices, such as computers or TVs. In terms of audio streaming services, Spotify seems to be taking the lead in Iraq, while Netflix is the leading paid video streaming platform.

A great deal of the surveyed participants expressed satisfaction with streaming services provided in Iraq, either video or audio.

In this brief, we look further into this market and address the challenges in Iraq. Several challenges contribute to limited options for streaming content. Iraq suffers from copyright infringement issues, pirated content, and weak internet services. In addition, the cash-based purchasing behavior and lack of localized content also significantly challenge the streaming services, which we explore in depth throughout this brief.

We conclude with a list of recommendations that are specifically designed and aimed toward each of the challenges mentioned earlier.

This brief can be cited as:

KAPITA. "The Rise of Streaming Services in the Iraqi Market”. August 25, 2023. http://tinyurl.com/55chtcp7

Strengths, Weaknesses, Opportunities and Threats

A Brief of the Iraqi Agritech Potential and Challenges

Many of the big businesses we know today were only ideas. Ideas that tackle real needs can become successful businesses if they... read more

Scope, Challenges, and New Horizons

Mobile & Web Applications Solutions and Timelines

An Overview of Food, Beverages, and Dairy Products