The Neglected Building Blocks of Iraq’s Economy

Safwa Salim, Executive Editor

Business LANDSCAPE, Magazine

Iraq has gone through a long determinantal period of sanctions that have caused the economy to deteriorate and be isolated from the international markets; it has also led Iraq to miss on the revolution that was sparked by the internet in the 90s and its positive impact on all different sectors and industries, but particularly in the banking sector and financial infrastructure. Emerging out of this age, Iraq has started to recover and reconnect with the global financial system, and numerous changes have been introduced to the banking sector and financial services. (Read more on page 33, Relieved from Economic Sanctions: Iraq the New Status in the Global Financial System by Abdulaziz Al Attar).

This period has also resulted in a severe lack of services in the country, such as financial technology, international e-commerce, freelancing, and content creation platforms, which is mainly caused by the financial payment issues that are the remnant of the sanctions coupled with the lack of risk appetite for investors and international corporates to operate in Iraq, in addition to the absence of adequate regulations that can create a friendly environment for those services to operate. Consequently, this led to many missing opportunities for Iraqis. (Read more on page 7, The Elephant in the Room: Investigating the Absence of International Services, Root Causes, and Missed Opportunities by KAPITA’s Research Team and Rawaz Rauf).

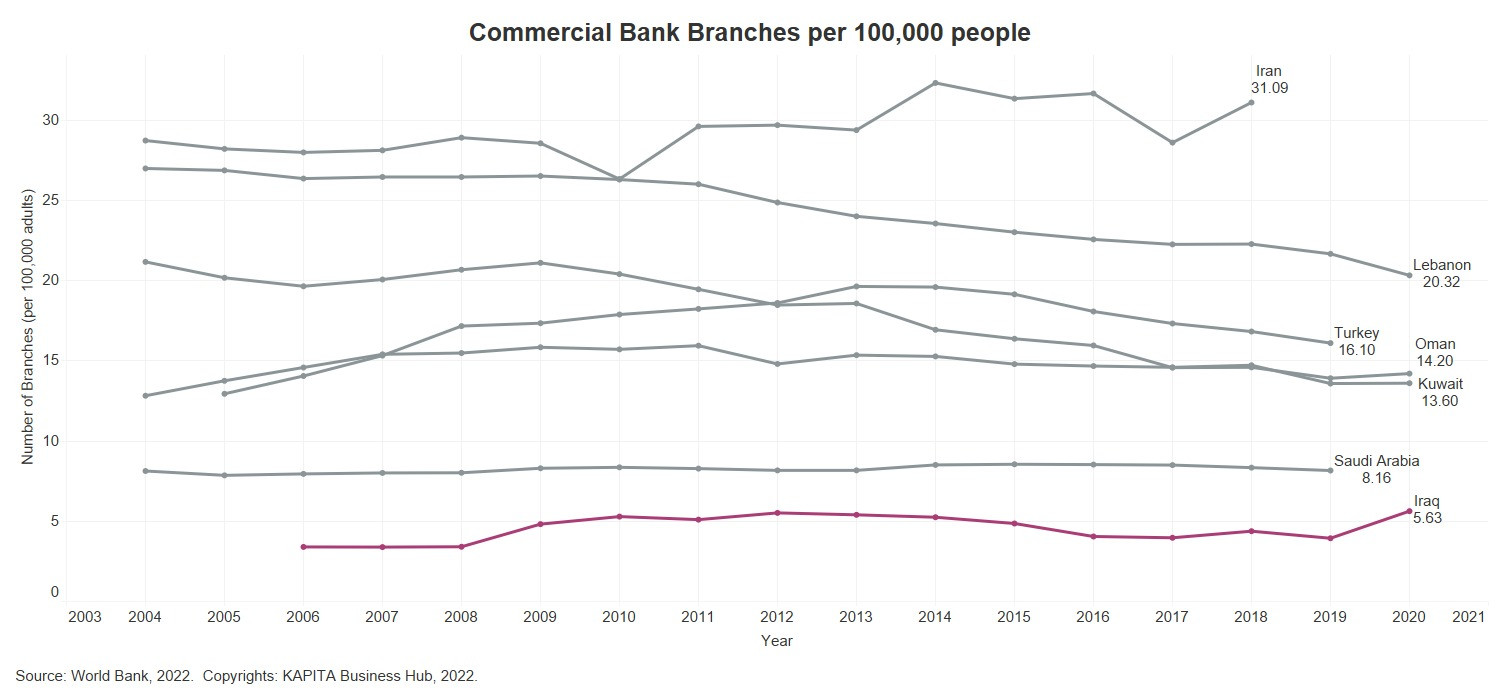

The banking sector and the financial infrastructure are discs in the spinal cord of any economy, and they enable its growth and foster its prosperity. The banking sector plays a crucial role in the mobility of assets and the supply of credits for businesses to scale. Regardless of the developments in the sector in Iraq in the last few years and the surge in digital payment services, the Iraqi economy is still cash-based and underbanked, with only less than 23% of the adult population having bank accounts and only 5.63 commercial bank branches per 100,000 adults, the lowest rates in the region compared to our neighboring countries. (Read more on page 38, Banking Sector and Financial Infrastructure Overview by KAPITA’s Research Team).

The low penetration and availability of bank branches and ATMs, combined with the lack of public trust in the banking sector and the marginal credit provided to the private sector, has hindered access to finance in Iraq for individuals and access to loans finance for small and medium-sized enterprises (SMEs) and small growing businesses (SGB). However, few loan financing opportunities have surfaced in an attempt to spur business growth such as Tamwil initiative by the Central Bank of Iraq and the launch of the Orange Corners Innovation Fund, yet ecosystem stakeholders should push to improve the access to finance in Iraq. (Read more on page 12, Access to Finance in Iraq: An Analytical Study by Abdal Ghany Al-Hassani).

Subsequently, the struggle surrounding access to finance in Iraq has been evident in the Iraqi startup scene; in KAPITA’s latest research, funding has been ranked as the most challenging aspect for scaling, with self-funding being the main funding source for entrepreneurs. (Read more page 48, Iraqi Entrepreneurs Journey V.2 New Trends and Insights by KAPITA’s Research Team).

That could also be attributed to the venture capital ecosystem experiencing many challenges ranging from the restrictions for foreign ownerships, underdeveloped commercial law provisions, and lack of judicial ruling stability, leaving the ecosystem with a few funding options and forcing investors to navigate complex solutions structures to mitigate those challenges. (Read more on page 28, Venture Capital Ecosystem in Iraq: Identifying the Gaps and Overcoming the Reluctance of the Laws and Regulations by Serge Airut).

On the other side of the funding table, SMEs and startups have not prioritized the proper accounting and bookkeeping and have not realized the significance of formal documentation in leading their operations. Those aspects are necessary in order to sustain the businesses and also facilitate the process when the business seeks access to finance. (Read more on page 20, Measure it to Manage it: The Role of Proper Accounting in the Success of SMEs in Iraq by Dr. Yass Alkafaji).

Regardless of all the aforementioned challenges, Iraq has been experiencing many positive changes on the ground; Iraqi startups raised double the amount of investment in 2022 compared to the past 3 years, the private sector is growing, and many regional players have entered the scene. In addition to lawmakers trying to implement reformation to mitigate the barriers in the ecosystem. This change can be further accelerated by the collective efforts of entrepreneurs, investors, financial institutions, ecosystem players, and stakeholders. (Read more on page 25, The Iraqi Private Sector We Need: Call to Action by Ali Al Suhail).

Building a robust Iraqi economy requires laying a strong and stable foundation that can only be established through a sustainable private sector and entrepreneurial scene that has the fertile ground to operate from banking and financial infrastructure, laws and regulations, capital market and stock exchange, and access to finance.

View the PDF Version of this article