This research is an updated, quantitative assessment of the Iraqi Entrepreneurs Journey: An In-Depth Analysis that was published by KAPITA in July, 2020, which was the backbone to understand the problems, solutions, opportunities, and challenges that entrepreneurs face in the Iraqi business ecosystem. Two years later, we are providing an updated, yet in itself a new, version to complement the previous findings with current insights. To understand the characteristics of the Iraqi entrepreneurial world, and provide the stakeholders, investors, researchers, and casual onlookers a detailed and straightforward picture of the advances within that world.

This research is a part of a series that KAPITA has undertaken to dive into the entrepreneurial scene. Which includes: "Iraq Entrepreneurs Journey: An In-depth Analysis", and, "Iraqi Startups Ecosystem Monitor" V1.0 & V2.0. Together with this research, we are trying to provide our readers a full picture of the Iraqi entrepreneurial ecosystem.

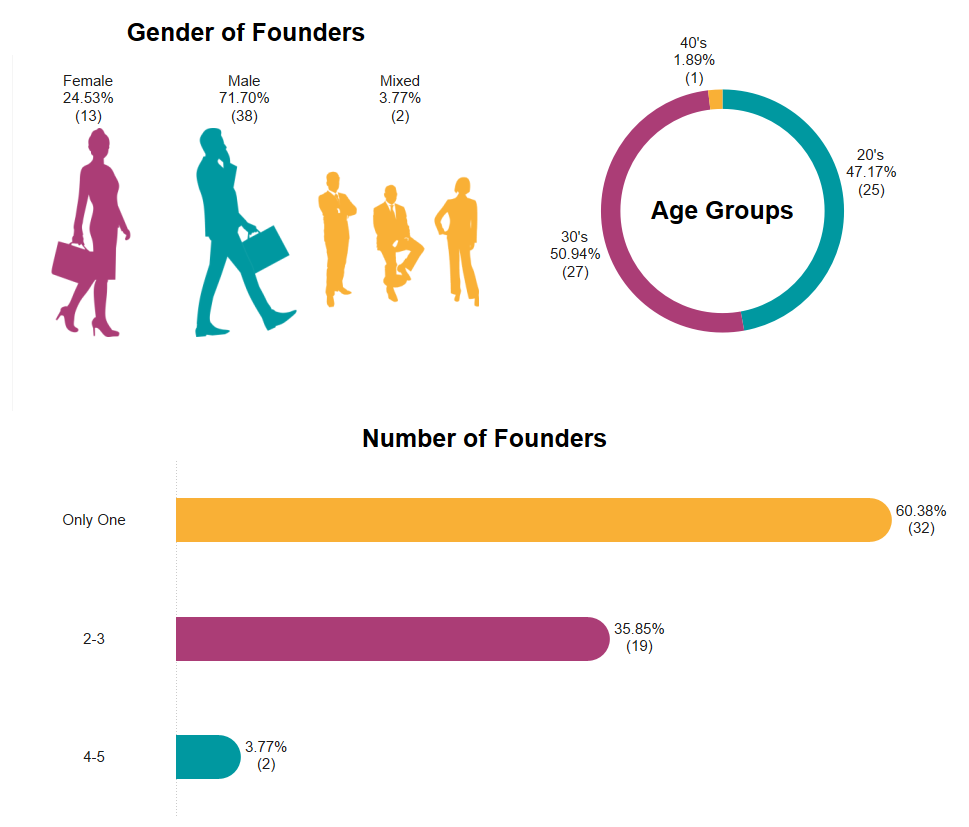

Age, Gender, and Number of Founders

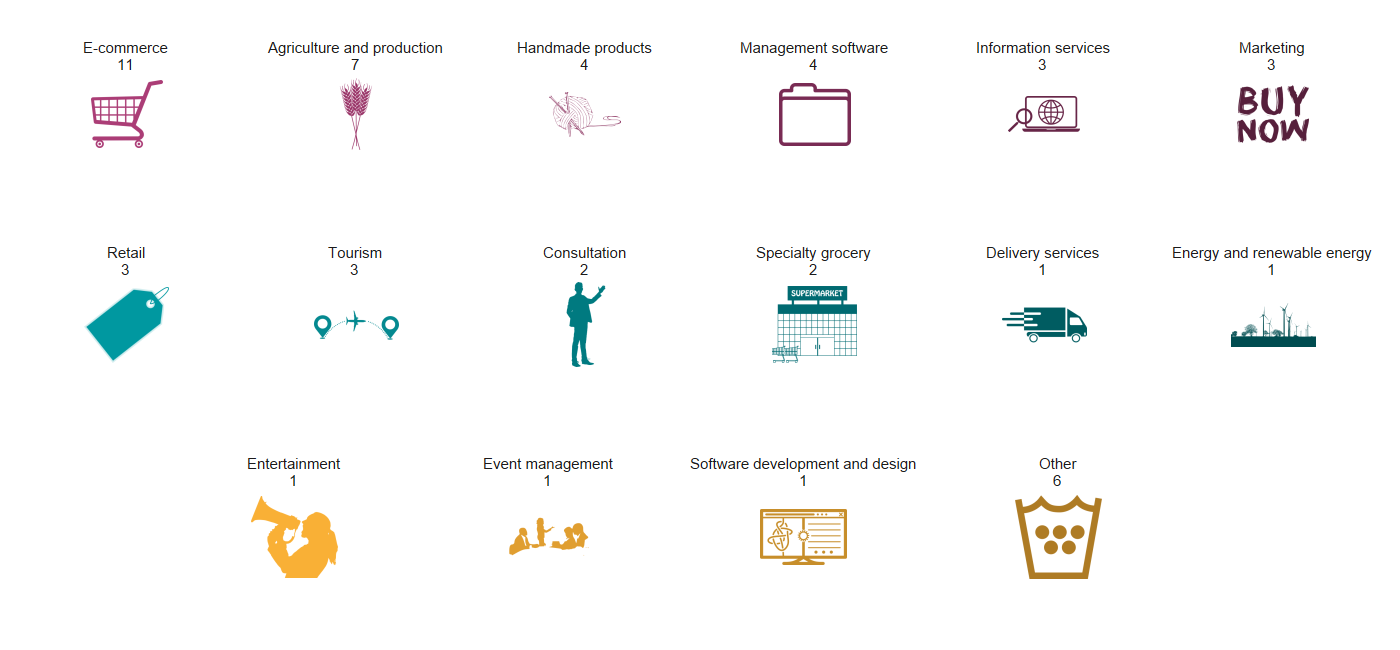

In comparison to the first version of this research, we could notice some clear differences between the two versions. In the previous research, retail startups formed the majority followed by e-commerce and management software startups. The scene has since changed, in the current research e-commerce startups took the lead while management software startups took the 4th place and retail startups took the 7th place. These differences can be attributed to several factors including: increased interest in e-commerce in Iraq, retail startups are more established now, and sampling differences between the previous and current research, as the current research is more inclusive than the previous one. On the same token, agriculture-related startups are on the rise which indicate an increasing interest in a very important sector in Iraq.

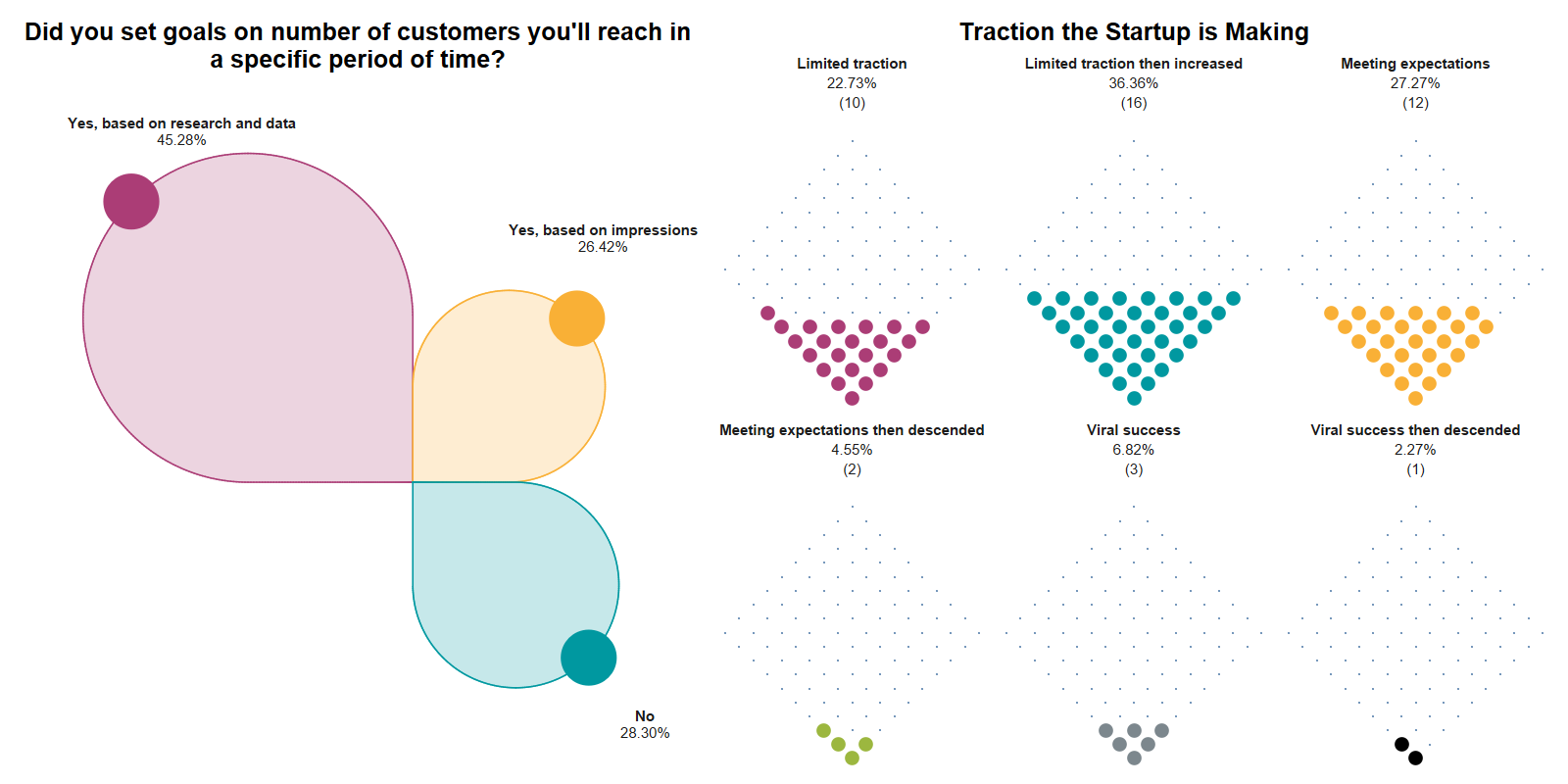

Goals and Customer Traction

Our findings indicate that the majority of the surveyed startups get limited traction that increases over time; the majority of surveyed respondents also claimed that they had set traction goals based on research and data. Combining goals based on research and data and having the patience to wait for traction to increase appears to be the most successful way to gain traction.

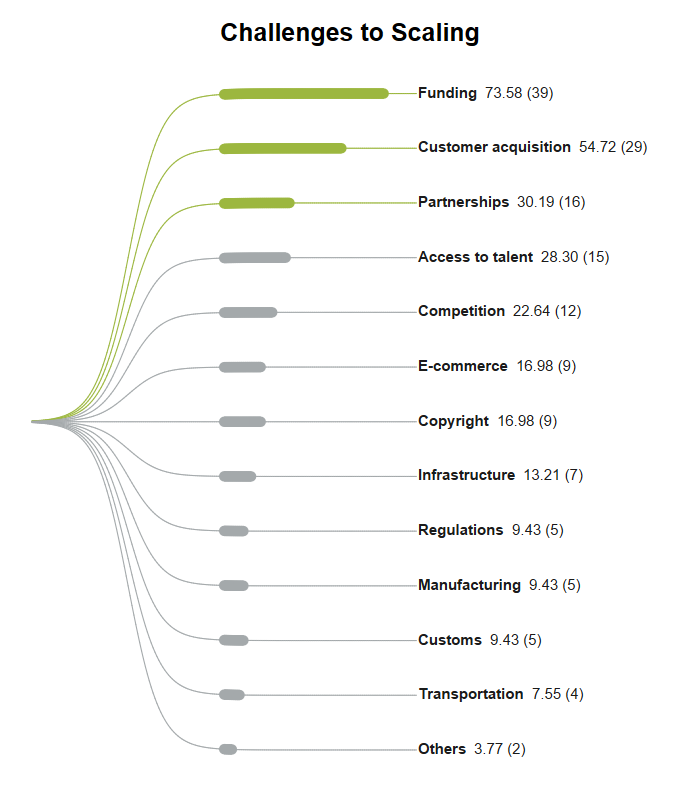

The weak financial infrastructure in Iraq has pushed funding to be the major issue to scaling. The findings indicate that funding was the most prevalent challenge to scaling, followed by customer acquisition, and partnerships. In our previous findings, competition was the most prevalent issue to scaling, while funding ranked lowly. This could be attributed to differences in types of startups or their young nature.

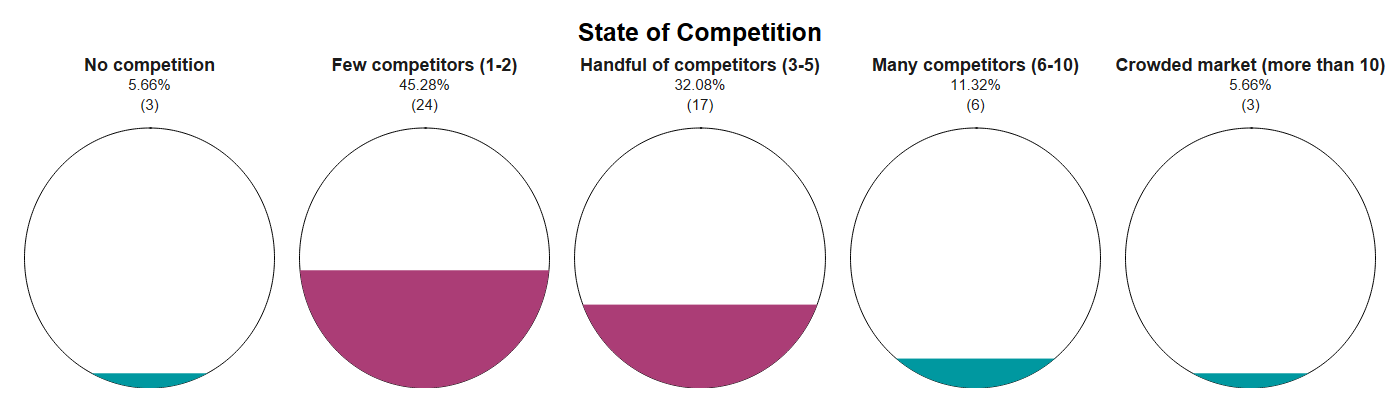

The current findings indicate that the current level of competition in Iraq is suitable to create variability but not too high to drive startups out of business.

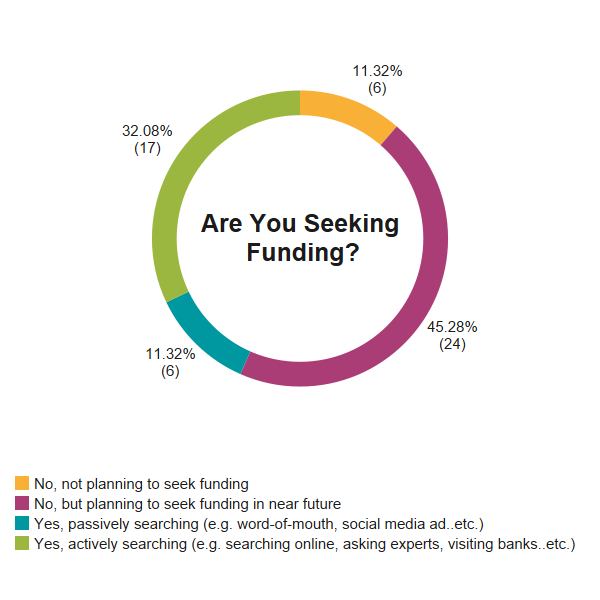

The majority of respondents are not seeking funding but planning to seek in the future which reflect on the immaturity of the funding infrastructure of the country, and the need of more improvement so it would be more appealing to the founders. While those who are actively seeking funds ranked second.

This research can be cited, as:

KAPITA Business Hub. (2022, April 13). Iraqi Entrepreneurs' Journey V.2 New Trends and Insights. KAPITA. Retrieved from: https://bit.ly/3rkxuwI