Recently, the focus on the dollar/dinar crisis has taken its fair share of media coverage and public discussion. Therefore, we at KAPITA find it necessary to shed light on this crisis due to its importance to the stability of the Iraqi economy and the public benefit. We highly take the Iraqi currency topic with all its relevant dimensions into account because it touches individuals, businesses, and institutions of all types and the impact it can have on developing the Iraqi ecosystem.

Throughout this brief, we take a peek at the early stages of the Iraqi banking system and the currency evolution. It begins during the 1930s, with the establishment of the Iraqi Currency Board, which laid the seed for the Iraqi banking system and the Iraqi currency. We break down the sequencing process of converting a barrel of oil into an Iraqi dinar in the market. We will be looking at the federal government and the KRG dollar value chains separately.

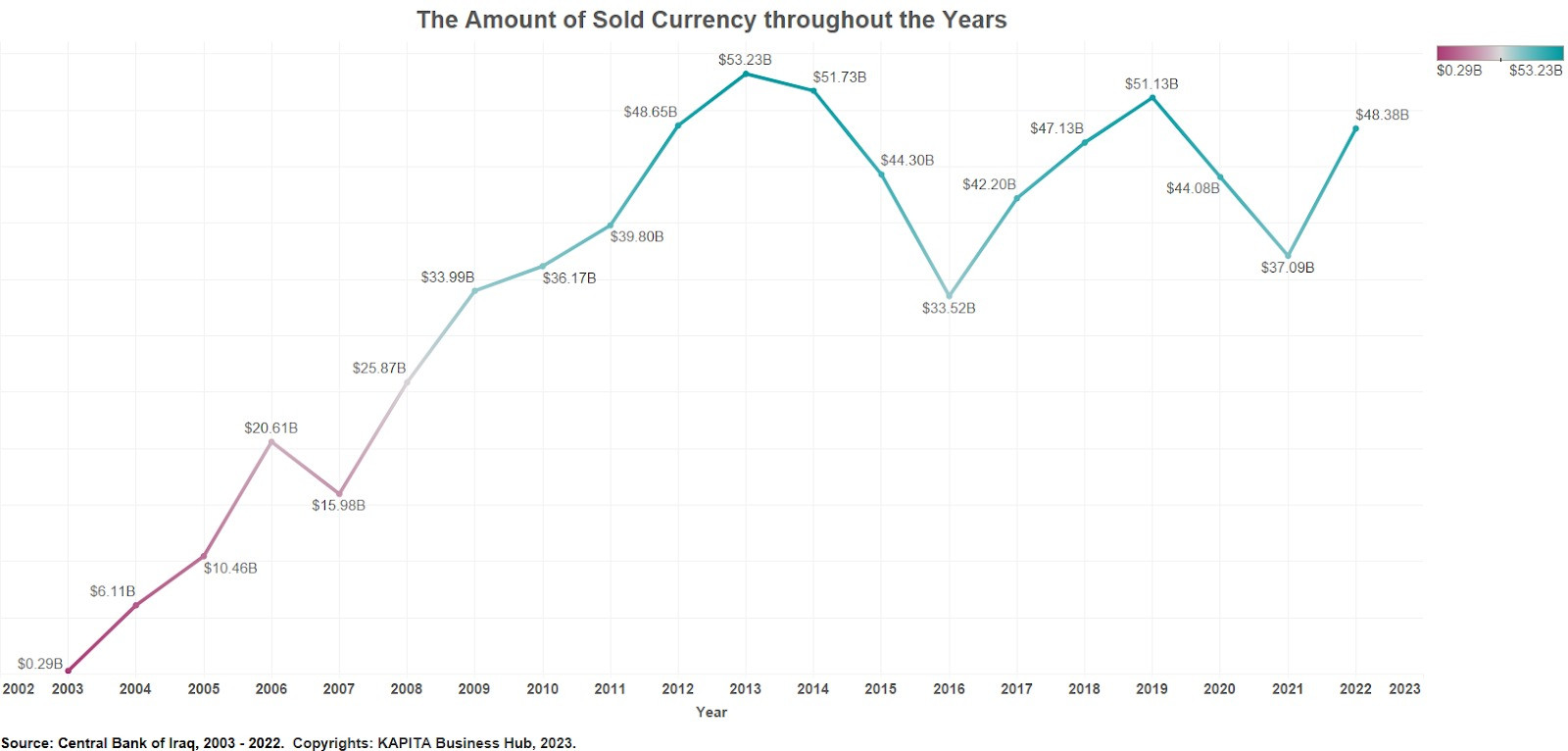

When discussing the Iraqi currency and the exchange rate, one key element is the CBI’s window (currency auctions). Data shows that the annual amount of U.S. dollars sold through this window since 2003 has reached higher levels, up to $53.23 and 51.73 billion dollars on some occasions.

We also highlight the impact of inflation on goods and services since prices have been increasing over the past years. Official data and some market studies demonstrate increasing prices during 2020 and 2021. The whole economy has inflated, especially transportation, tobacco, health, food, and non-alcoholic beverages, which have been hit the most as they increased by 15.9%, 13.6%, 12.2%, and 4,8%, respectively, especially from 2021 onwards.

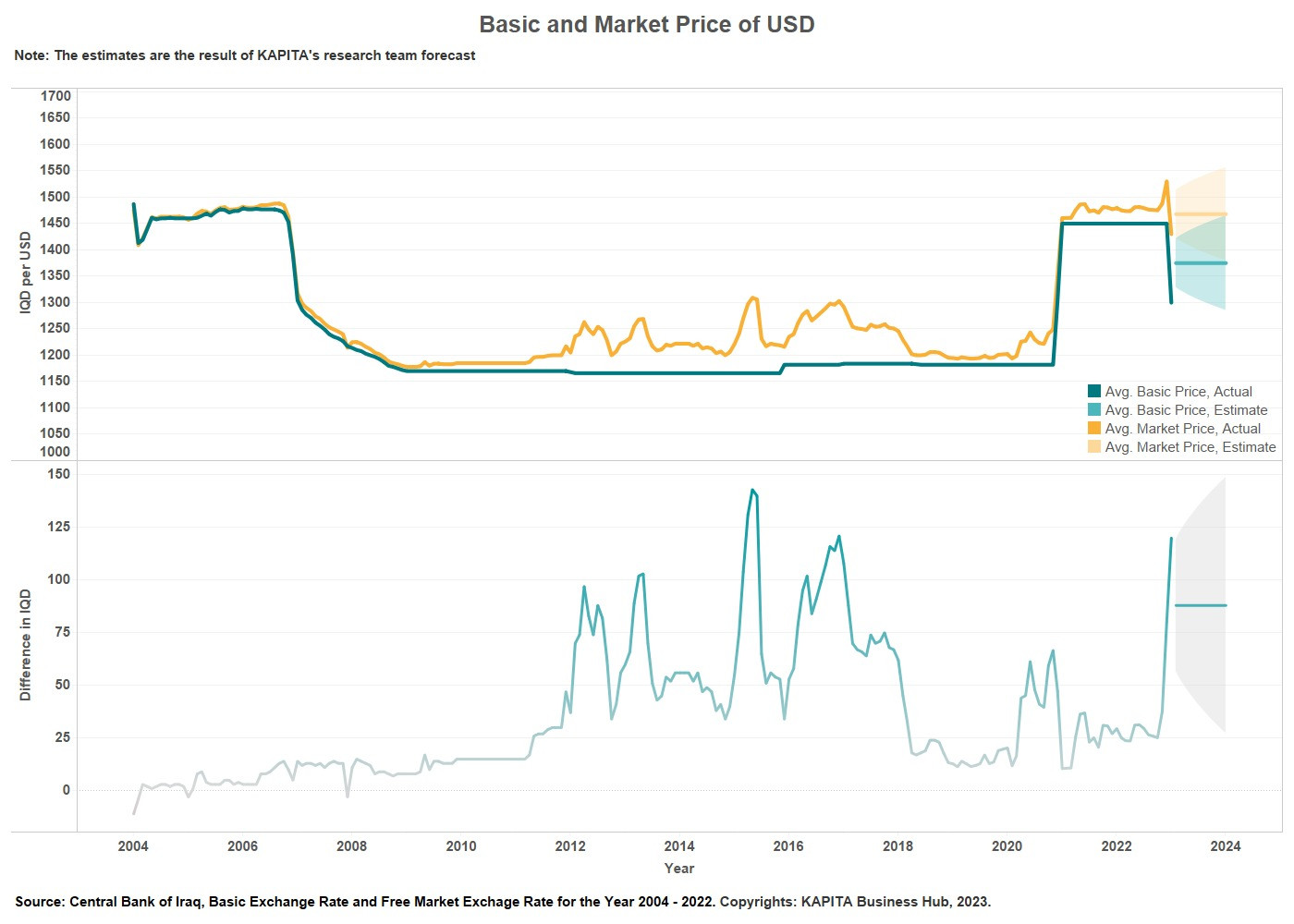

Halfway through, we explore the official and the free market exchange rate from 2004 up until 2023. Over the past three years, there have been two exchange rate adjustments by the CBI, whereas the free market exchange rate constantly fluctuates with higher gaps between them. These adjustments were reactions to certain economic factors, which we will explore in detail later on. The free market exchange rate, on the other hand, is susceptible to several factors including demand and supply.

Money transfer is an essential aspect of the Iraqi economy due to its impact on money movement domestically and intentionally. As a result, we will learn about the methods used domestically and internationally that are provided by telecommunication companies, prepaid card companies, and international money transfer companies. Another method is the hawala system which is an unofficial method of transferring and does not require banking system facilities.

We conclude with recommendations targeting the banking system and non-banking financial institutions. They should expand their reach nationwide through well-planned ATM distribution and increase their social awareness campaign to spread financial literacy across the Iraqi community. More to that, public and private banks should invest more and increase their participation in the agriculture and industry private sectors. Additionally, the related institutions should provide affordable customer services in terms of lower fees and affordable card prices.